Allison Martin is a personal finance enthusiast and a passionate entrepreneur. With over a decade of experience, Allison has made a name for herself as a syndicated financial writer. Her articles are published in leading publications, like Banks.com, Bankrate, The Wall Street Journal, MSN Money, and Investopedia. When she’s not busy creating content, Allison travels nationwide, sharing her knowledge and expertise in financial literacy and entrepreneurship through interactive workshops and programs. She also works as a Certified Financial Education Instructor (CFEI) dedicated to helping people from all walks of life achieve financial freedom and success.

Updated June 4, 2023

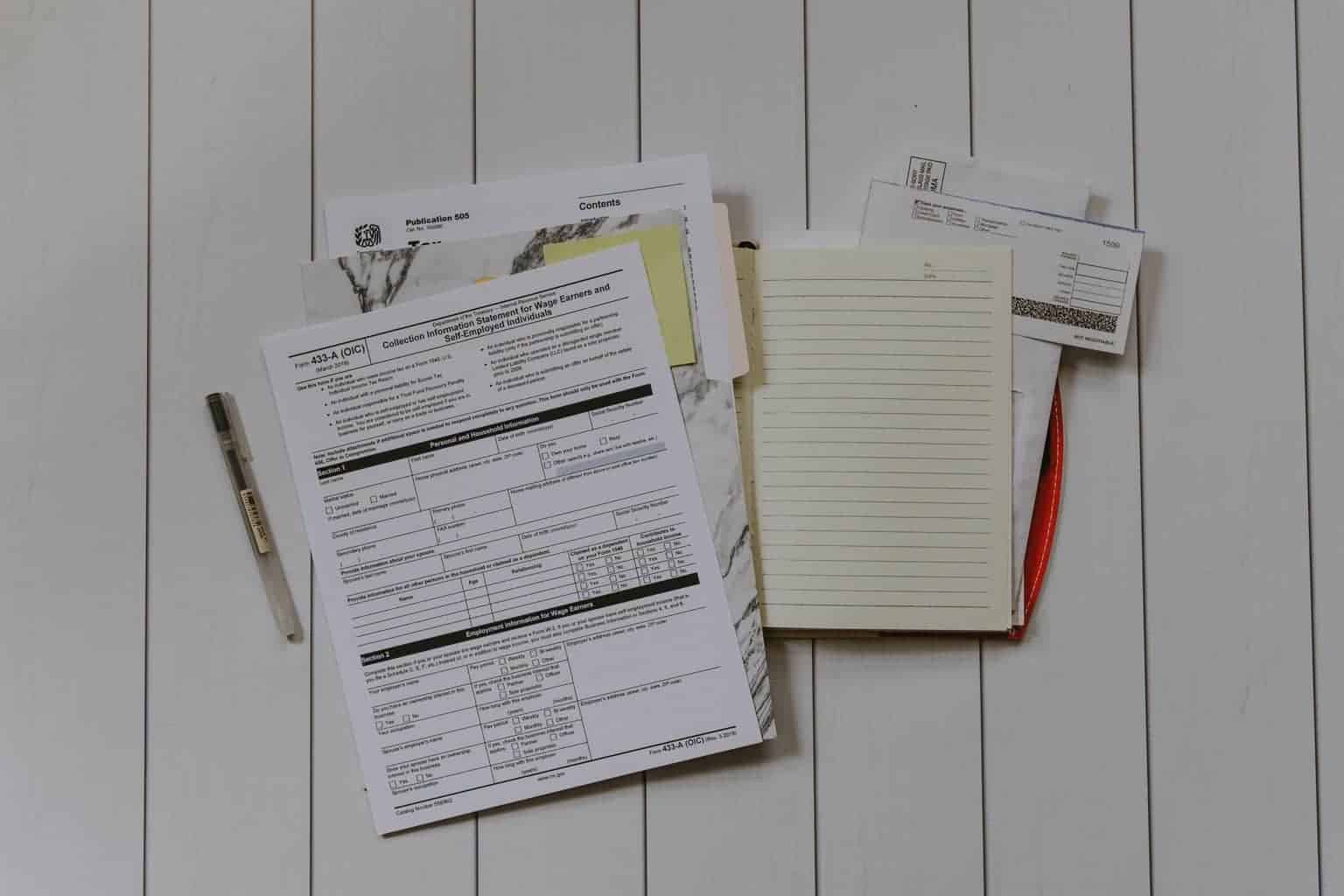

If you’re saddled down by federal tax debt, there’s hope. The Internal Revenue Service (IRS) offers many options, like short-term and long-term payment plans, to help resolve your unpaid tax bill.

In this guide, you’ll learn more about these payment plans, also known as installment agreements, how they work and what you’ll need to request an arrangement with the IRS using form 9465.

Loading. Loading.Form 9465 (Installment Agreement Request) is used by taxpayers who cannot pay their federal tax liability and would like a monthly installment plan.

The IRS offers detailed instructions online to help you complete Form 9465. You can also find the mailing address, which varies by state, to send Form 9465 if you’d prefer to apply for an installment agreement by mail.

If you read the instructions for Form 9465 and are still uncomfortable with requesting an installment agreement on your own, consider hiring a tax relief firm to assist. They can work with the IRS on your behalf to negotiate an installment agreement that’s fair and works for your financial situation.

The IRS offers installment agreements to help taxpayers resolve unpaid tax debt over an extended period. Some state taxing authorities also offer installment payment plans. (Quick note: If you’re facing a tax bill from your state, contact the department of taxation or revenue in your state to learn more about payment plans that could be available to you).

The interest rate on IRS installment agreements is equivalent to three percent plus the federal short-term rate. Each quarter, it’s adjusted in accordance with the federal short-term rate. Also, know that interest compounds daily on the unpaid tax debt as well as on late filing penalty and late payment penalties.

Businesses

If certain conditions are met and your account is eligible. Below is the setup fee for online, mail or phone filing options:

You could qualify for a $43 setup fee, regardless of how you file, if you’re a low-income individual.

Already filed and need to update your installment agreement? Create an account and make modifications, like monthly payment amount, due date or payment account changes, through the Online Payment Agreement tool. If your installment agreement has lapsed, you may be able to request reinstatement through this tool. There’s a $10 fee to make changes online; it’s $89 for changes made by mail, phone or in-person. (The fee is reduced to $43 for low-income taxpayers and could be reimbursable, and$0 for modifications to DDIA).