Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

The Cash Conversion Cycle (CCC) is a metric that shows the amount of time it takes a company to convert its investments in inventory to cash. The conversion cycle formula measures the amount of time, in days, it takes for a company to turn its resource inputs into cash. Learn more in CFI’s Financial Analysis Fundamentals Course.

The cash conversion cycle formula is as follows:

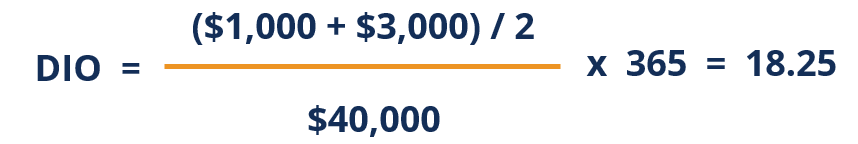

Days Inventory Outstanding (DIO) is the number of days, on average, it takes a company to turn its inventory into sales. Essentially, DIO is the average number of days that a company holds its inventory before selling it. The formula for days inventory outstanding is as follows:

For example, Company A reported a $1,000 beginning inventory and $3,000 ending inventory for the fiscal year ended 2018 with $40,000 cost of goods sold. The DIO for Company A would be:

Therefore, it takes this company approximately 18 days to turn its inventory into sales.

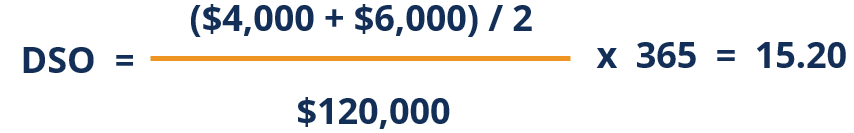

Days Sales Outstanding (DSO) is the number of days, on average, it takes a company to collect its receivables. Therefore, DSO measures the average number of days for a company to collect payment after a sale. The formula for days sales outstanding is as follows:

For example, Company A reported $4,000 in beginning accounts receivable and $6,000 in ending accounts receivable for the fiscal year ended 2018, along with credit sales of $120,000. The DSO for Company A would be:

Therefore, it takes this company approximately 15 days to collect a typical invoice.

Days Payable Outstanding (DPO) is the number of days, on average, it takes a company to pay back its payables. Therefore, DPO measures the average number of days for a company to pay its invoices from trade creditors, i.e., suppliers. The formula for days payable outstanding is as follows:

For example, Company A posted $1,000 in beginning accounts payable and $2,000 in ending accounts payable for the fiscal year ended 2018, along with $40,000 in cost of goods sold. The DSO for Company A would be:

Therefore, it takes this company approximately 13 days to pay for its invoices.

Recall that the Cash Conversion Cycle Formula = DIO + DSO – DPO. How do we interpret it?

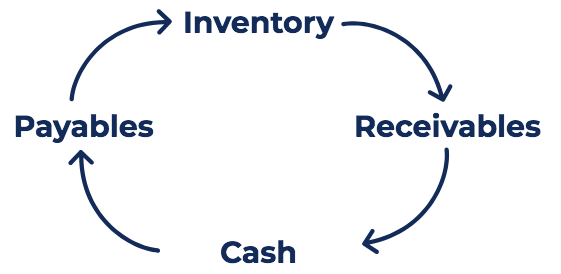

We can break the cash cycle into three distinct parts: (1) DIO, (2) DSO, and (3) DPO. The first part, using days inventory outstanding, measures how long it will take the company to sell its inventory. The second part, using days sales outstanding, measures the amount of time it takes to collect cash from these sales.

The last part, using days payable outstanding, measures the amount of time it takes for the company to pay off its suppliers. Therefore, the cash conversion cycle is a cycle where the company purchases inventory, sells the inventory on credit, and collects the accounts receivable and turns them into cash.

Using the DIO, DSO, and DPO for Company A above, we find that our cash conversion cycle for Company A is:

Therefore, it takes Company A approximately 20 days to turn its initial cash investment in inventory back into cash.

The CCC formula is aimed at assessing how efficiently a company is managing its working capital. As with other cash flow calculations, the shorter the cash conversion cycle, the better the company is at selling inventories and recovering cash from these sales while paying suppliers.

The cash conversion cycle should be compared to companies operating in the same industry and conducted on a trend. For example, measuring a company’s conversion cycle to its cycles in previous years can help with gauging whether its working capital management is deteriorating or improving.

In addition, comparing the cycle of a company to its competitors can help with determining whether the company’s cash conversion cycle is “normal” compared to industry competitors.

Thank you for reading CFI’s guide to Cash Conversion Cycle. To keep learning and advancing your career, the following CFI resources will be helpful:

Stand out and gain a competitive edge as a commercial banker, loan officer or credit analyst with advanced knowledge, real-world analysis skills, and career confidence.